Are you trying to decide between Stripe vs PayPal for your online payment processing needs? Both platforms have a lot to offer when it comes to eCommerce features and flexibility. However, they do have their differences.

PayPal is considered almost an industry standard with a wide range of interrelated products such as mobile payments and financial services. Stripe, on the other hand, has a long list of popular customers and partners, but may not be as well-known to online users in certain countries.

It’s important to note that neither Stripe nor PayPal offers the cheapest payment processing rates and if cost is your only concern, a regular merchant account may be a better option. However, if you’re looking for a wealth of eCommerce options, such as support for digital products, subscriptions, and mobile payments, both Stripe and PayPal are great choices.

In this article, we’ll compare Stripe vs PayPal and help you determine which platform is the best fit for your business. So, whether you’re just starting a business or looking to switch payment processors, read on to find out more about these two popular platforms.

What is Stripe?

Stripe is an international system for secure online payments using plastic cards. Simply put, Stripe acts as an intermediary between the buyer and the seller, who makes a payment that is safe and protected.

- Stripe solves problems related to card payments, including storing card data, recurring payments, and bank withdrawals.

- Stripe system is known for its fast payment processing and security, and easy integration with websites for businesses.

- Stripe meets international security standards and has the highest level of certification in the payments industry, PCI Level One.

- Stripe has a reputation for reliability, security, good documentation, and ease of integration with sites.

Pros and Cons of Stripe

Pros

- Easy Setup and Use

- Global acceptance and coverage

- Wide range of Payment options

- Customizable Checkout Experience

- Strong security measures

Cons

- Fees for each transaction

- Limited Support options provided

- Some features are exclusive to certain countries only

- Limited access to funds

- Difficult for some types of businesses to integrate

What is PayPal?

This is the most popular way to receive and send online payments in most online stores around the globe. With over 377 million total active accounts are one of the fastest-growing electronic payment systems in the world.

Why is PayPal so popular?

- First, it allows for easy global payments in any currency with fast transaction processing.

- Second, it offers speed and simplicity with no need to enter multiple lines of bank or payment card details.

- Third, it provides a level of security by keeping payment card details private.

- Lastly, it offers purchase protection and the ability to return money in case of issues with the seller.

PayPal provides the following services to its users:

- Send Money: Allows users to transfer funds from their PayPal account or linked bank account/card.

- Money Request: Allows users to send payment requests to individuals or groups of debtors.

- Web Tools: Allows Premier and Business account owners to add tools for accepting payments on their websites.

- Auction Tools: Offers automatic payment request emails and the ability for auction winners to make payments directly from the auction website.

At the moment, the full package of services is available only to residents of the United States. For many countries, it is very limited. There are a lot of countries that can only send money via PayPal while receiving is not available. Therefore, shortly, we can expect an even greater expansion of opportunities for users in other countries.

Pros and Cons of paypal

Pros

- Widely Accepted

- Highly Secure

- Buyer friendly

- Easy International Transfers

- Easy to use

Cons

- Fee for certain transactions

- Holding funds in certain cases

- Not seller friendly

- Technical issues

Read: 🚩 WooCommerce Payment Gateways and Taxation Guide

Stripe Vs PayPal: Key features comparison

| Feature | Stripe | Paypal |

|---|---|---|

| Payment Processing Fees | 2.9% + 30 cents per transaction | 2.9% + 30 cents for domestic transactions, slightly higher for international |

| Security | PCI Level One certification, international security standards | SSL encryption, PCI compliance, fraud detection, and prevention |

| Supported Currencies | Over 135 currencies | Over 200 currencies |

| Ease of Use | Developer-friendly, more advanced features and customization options | User-friendly, more intuitive interface, often used for personal transactions |

| Integrations and developer support | Wide range of developer resources, API documentation, and developer communities | API documentation and developer resources, smaller community compare to Stripe |

Stripe Vs Paypal: Ease of Use

Another important aspect to consider when comparing Stripe vs PayPal is their ease of use. Both platforms offer simple processes for setting up and using their services.

Stripe Payment setup and ease of use

Stripe has a simple account creation process and offers easy integration options for various eCommerce platforms, such as WooCommerce and Shopify. Let us see how you can set up Stripe in a simple WordPress site first.

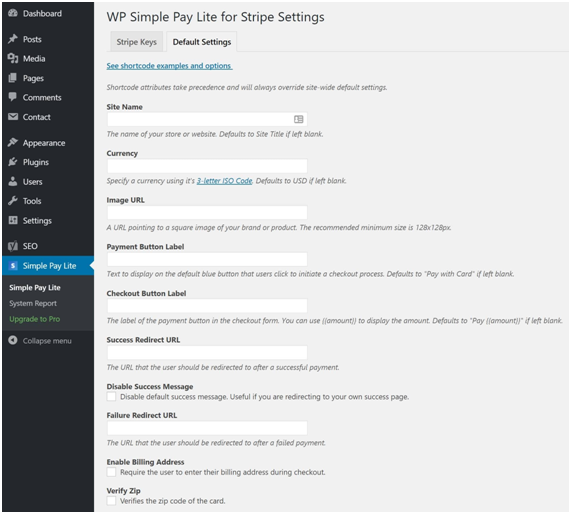

Basic WordPress Site — WP Simple Pay Lite for Stripe WordPress plugin-

- Search, download, and install the WP Simple Pay Lite for Stripe plugin.

- Add the Stripe API key, which you can take from the Stripe dashboard, and save the change

- Go to the Default Settings tab on the plugin page and fill in all the required information about your site like name, image, currency, etc. Save all the changes.

- Add the payment button with the shortcode. It must look like the following: [stripe name=”My Store” description=”My Product” amount=”1999″]

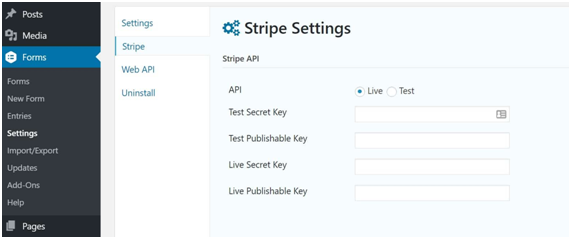

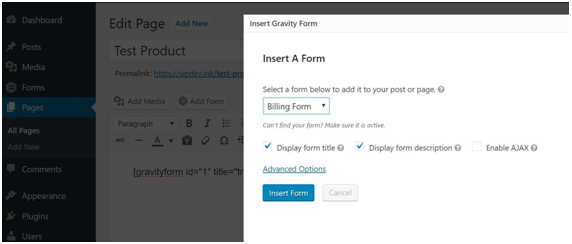

Gravity Forms-

- Install the Gravity Forms plugin.

- Add the Stripe API keys and save changes.

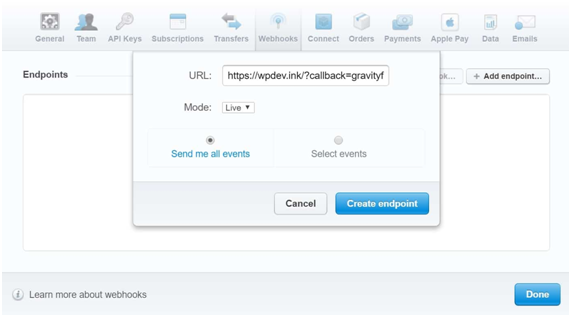

- Log in to the Stripe Webhooks management page: https://dashboard.stripe.com/account/webhooks.

- Click on the Add Endpoint button.

- Click the “Add Endpoint” button above the list of Webhook URLs.

- Add the URL: https://yourdomain.com/?callback=gravityformsstripe and activate the Live

- Click on the Create Endpoint button.

- Update the setting in the new window.

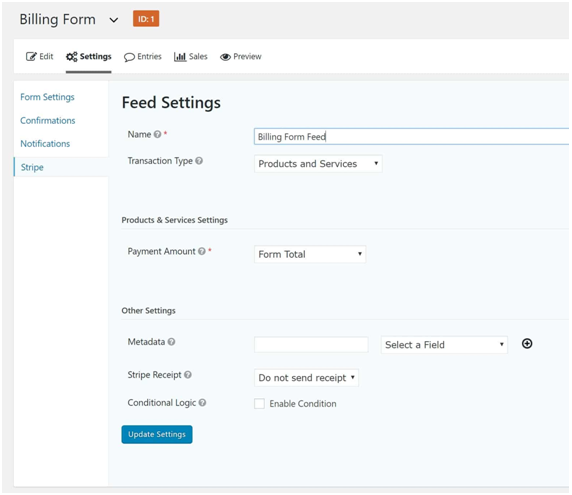

- Create the new form and configure any data you require on your website.

- Add the form to Stripe. In the form settings, go to the Stripe tab and add all the payment information.

- Add the created form to the page or post. Go to Gravity Form settings, select the form you previously created, and insert it into the page.

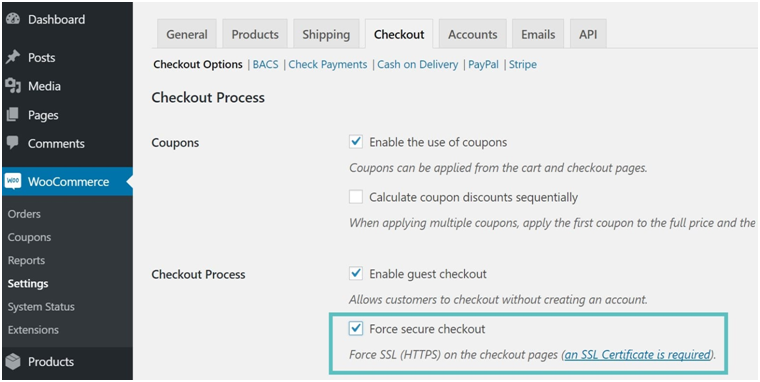

WooCommerce — WooCommerce Stripe Payment Gateway plugin-

- Install the plugin to use Woocommerce with stripe.

- In WooCommerce settings, add the Stripe API keys in the Checkout tab.

- In the Checkout tab, activate Force secure checkout and save changes.

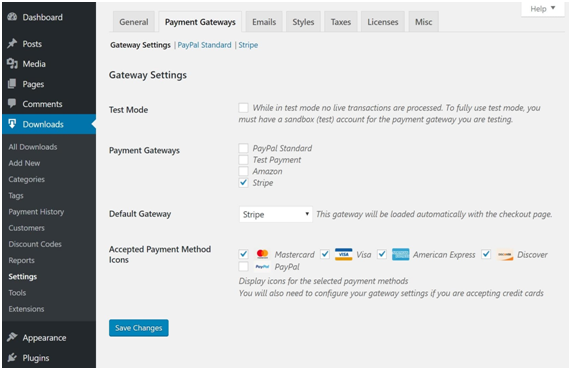

Easy Digital Downloads — Stripe payment gateway extension-

- Install the plugin.

- On the plugin page, go to Settings — Payment Gateways and check Stripe and all supported payment methods.

- Configure Webhooks the same way we described in the Gravity Forms section.

Paypal Payment setup and ease of use

There are a lot of free tools to use for PayPal on your WordPress website. Let’s review the four best ones. In the beginning, make sure you can access the WordPress dashboard. It is necessary to install the required plugins.

Digital Goods plugin-

- Install & Activate the plugin.

- Open the Settings page, then select PayPal for Digital Goods.

- Select the currency you are going to use in your store and add the default text for the Buy Now button. Your buyers will see the button when they buy something on your site.

- Add the PayPal Credentials: PayPal API Username, PayPal API Password, and PayPal API Signature. You can find them in your PayPal account.

- If you are unsure how it works, test everything in the Sandbox Mode. However, do not forget to activate the Live Mode box when everything is ready.

- Having applied the necessary changes, click the Save Changes button.

- Edit a WordPress page where you are going to add the payment button and add the following shortcode: paypal_for_digital_goods. Also, add the following parameters: name, price, URL, and button_text.

- Customize the shortcode for your specific needs.

- Update the page, then check how it looks on the page in real time.

Shortcode Example:

[paypal_for_digital_goods name=”My eBook” price=”25″ url=”http://your-domain.com/my-ebook-file.zip” button_text=”Buy Now”]

PayPal Donations plugin-

- Open the homepage of your WordPress Dashboard, go to the Plugins tab, and click Add New button.

- In the search field, type PayPal Donations.

- In the search results, click Install Now, then Activate the plugin.

- Open the Settings page, then select PayPal Donations.

- Enter your PayPal email address in the PayPal Account box.

- Choose any settings in the Optional and Default tabs.

- Having applied the changes, save them.

- Next, Open Appearance — Customize — Widgets.

- Select Sidebar as a Widget Location, and click on Add a Widget button.

- At the bottom of the page, click on PayPal Donations.

- You may remain with default settings, however, you can change the preferred ones according to your needs.

- In addition, you can customize the location of the widget on the page. For that, click on the Visibility button.

- On the Live Preview screen on the right side of the screen, preview the Widget.

WP Easy Paypal Payment Accept plugin-

- Open the homepage of your WordPress Dashboard, go to the Plugins tab, and click Add New button.

- In the search field, type WP Easy Paypal Payment Accept.

- In the search results, click Install Now, then Activate the plugin.

- Open the Settings page, then select WP Easy Paypal Payment Accept plugin.

- Type in the PayPal Email Address.

- You may remain with default settings, however, you can change the preferred ones according to your needs.

- Click on the Update Options button.

- Edit a WordPress page where you are going to add the payment button and add the following shortcode: wp_paypal_payment

- Update the page to check if the changes have been applied.

WordPress Simple Paypal Shopping Cart plugin-

- Open the homepage of your WordPress Dashboard, go to the Plugins tab, and click Add New button.

- In the search field, type WordPress Simple Paypal Shopping Cart.

- In the search results, click Install Now, then Activate the plugin.

- Open the Settings page, then select the WordPress Simple Paypal Shopping Cart plugin.

- Enter the PayPal Email Address.

- You may remain with default settings, however, you can change the preferred ones according to your needs.

- Click on Update Options.

- Edit a WordPress page where you have a product for sale, and use the following Shortcode: wp_cart_button. Also, add the following parameters: name and price.

- To display the shopping cart, add the following shortcode: show_wp_shopping_cart.

Read: 🚩 How to Start a Web Hosting Business? (Step by Step Guide)

Stripe or PayPal Products and Services?

PayPal’s main goal has always been payment processing: enabling any user to make a payment to a seller using PayPal’s balance or credit/debit card. But nowadays, merchants using PayPal have access to various additional services that go beyond the sale.

PayPal has three service plans:

- Express Checkout

- Payments Standard

- Payments Pro

Other PayPal services include:

- PayPal Here: mPOS app from PayPal

- POS software integration

- Payment page (with PayPal Pro subscription)

- PCI compliance

- PayFlow Payment Gateway

- Online distribution

- Virtual terminal

- Digital goods

- Subscriptions

- Donation tools

- Buy Now buttons

- Mass Payout

- PayPal Credit: providing interest-free financing to customers

In addition, PayPal offers SDK and other tools for developers, so you can create custom integrations — and even run your mobile payment application with Android and Apple support.

Like PayPal, Stripe’s main function is online payments. The company offers its customers opportunities to complement its main offer, but, unlike PayPal, they complement more. Here are the main features of Stripe:

- Payment processing

- Payment page (data entry fields for purchase payment)

- PCI compliance

- Customizable payment

- Subscriptions

- Trading tools

- Platform tools

- Coupons

- Customizable reporting tools

- Buy Now buttons in mobile apps

It should be noted that Stripe claims to have more than 100 functions. This is a very reliable platform that can serve almost any Internet company. In addition to general functions, you will also find the Stripe Atlas toolkit, designed to help international entrepreneurs start a business. Stripe also has a robust API for easy integration with many other applications. However, the integration supports Android and Apple.

Stripe vs PayPal: Conclusion

After all, no one thinks it’s easy to find a clear winner in the Stripe vs PayPal debate.

Ultimately, the choice depends on your needs. If you have experience and want to create an individual online store, Stripe is the best choice. PayPal will be more suitable if you are not a developer, do not want to hire him, or do not have big needs.

Although you do not receive a payment page without a $30 monthly subscription, PayPal is a reliable and secure service. So, there’s nothing to worry about when PayPal redirects its customers to its website to complete the transaction.

Frequently Asked Questions

Is it better to use Stripe or PayPal?

Stripe has evolved as a better option than Paypal in terms of the high volume of sales and if you are receiving payments in different forms. However, Paypal is an option for businesses that want a well-established processor with wide acceptance, buyer protection, and additional services.

Why use Stripe instead of PayPal?

Stripe is new and it can be beneficial for some users in terms of

1. Stripe has a simple pricing structure.

2. Stripe offers a wide range of features than Paypal, such as the facility to create subscriptions, issue refunds, and handle disputes.

3. Multiple integration options are provided.

4. Stripe API is more robust

5. Stripe has better customer service than PayPal.

What are the cons of Stripe?

The cons of the stripe are:

1. Limited currency support.

2. Limited fraud protection

3. Integration issues

4. No recurring billing feature

5. Higher fees for certain types of transactions.

I am a Co-Founder at WPOven INC currently living in Vancouver, Canada. My interests range from Web Development to Product development and Client projects. I am also interested in web development, WordPress, and entrepreneurship.

Paypal is the best payment option internationally. So, I will personally recommend paypal to the users.

Great article!

If you decide to use Gravity Forms and Stripe to handle subscriptions on your site. I highly recommend adding the FREE plugin called GravityStripe from the WordPress plugin repository.

It shows a list of all subscribers. Whether their accounts are active, cancelled or overdue, and gives admins and users the ability to cancel the subscription with the push of a button. Subscribers can access their subscription info, date started, amount they are billed, etc.